DOWNLOAD

Submit the form below to continue your download

SUCCESS

Your download will begin shortly, if it does not start automatically, click the button below to download now.

DownloadBIO

Aaron serves as Head of Portfolio Management at Generate Capital responsible for performance improvement and value creation across Generate’s $7bn+ sustainable infrastructure portfolio.

Aaron has 20+ years of global experience advising energy and infrastructure investors, operating companies, growth companies, developers and governments on core business strategy, investment strategy, financing strategy and capital deployment / infrastructure development and public private partnerships, value creation initiatives, technology roll out programs, transformations and restructurings in North America, Europe, Middle East and Latin America/Caribbean. Aaron has worked extensively across energy transition sectors (renewable power generation, battery storage, hydrogen, clean mobility, waste, water) and core infrastructure sectors (ports, airports, roads, logistics, power and water utilities) and is a frequent speaker and author on sustainable infrastructure financing topics. Prior to Generate Aaron was a Managing Director and Partner at Boston Consulting Group leading work with infrastructure investors on portfolio value creation and supporting governments on large scale infrastructure development and construction programs. Prior to that Aaron was a Partner at McKinsey & Co. where he led large scale transformation programs at power and water utilities, supported development finance institutions and government agencies on infrastructure investment and funding strategy and supported infrastructure investors on strategy and performance improvement programs in the Middle East, Europe, Africa and North America and served on the Millenium Challenge Corporation’s private sector advisory board. During his work advising on the Puerto Rico sovereign restructurings, Aaron was appointed the Revitalization Coordinator for Puerto Rico by the Governor of Puerto Rico and the Federal Oversight Management Board. Prior to McKinsey Aaron was a Senior Associate at Latham & Watkins where he structured and executed project financings, leveraged financings, mergers and acquisitions and large-scale restructurings, including the restructuring of Dubai World for the Government of Dubai. While in Dubai, Aaron founded the Middle East’s first energy transition focused business group the Clean Energy Business Council MENA. Aaron was also an Investment Banking Associate in Credit Suisse’s Energy Group focused on infrastructure financings and M&A. Aaron was a Hamilton Scholar at Columbia Law School where he was awarded a J.D. and graduated from Brown University with a B.A. with Honors. He lives in Washington DC.

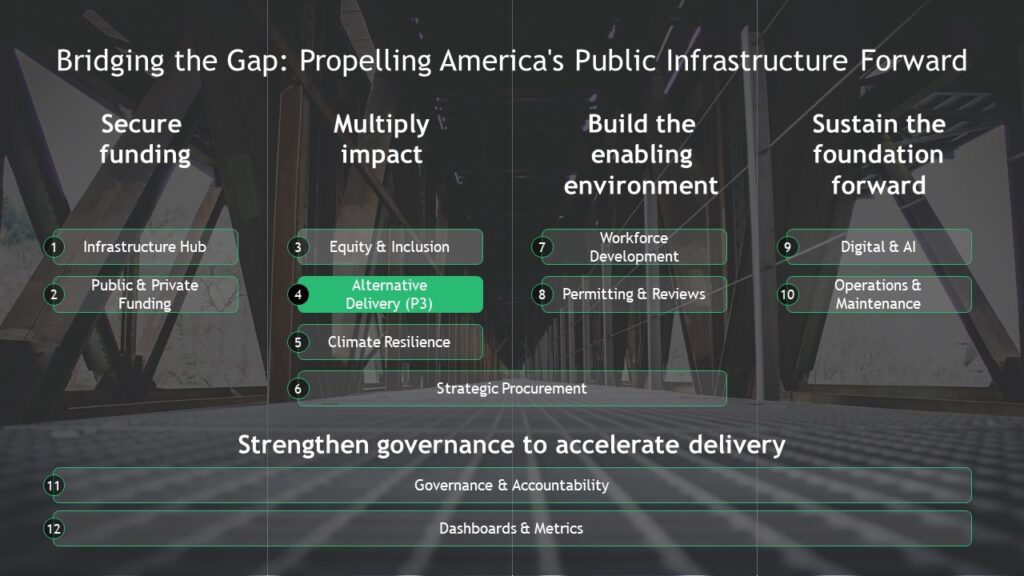

Alternative Delivery: Exploring Beyond Traditional Execution Models

to Deliver Better Assets Faster. In the United States, we are in the midst of a once-in-a-generation initiative to rebuild our nation’s aging infrastructure and transform our built environment to support sustainable and inclusive future growth.

Expert View By Aaron Bielenberg

BIO

Aaron serves as Head of Portfolio Management at Generate Capital responsible for performance improvement and value creation across Generate’s $7bn+ sustainable infrastructure portfolio.

Aaron has 20+ years of global experience advising energy and infrastructure investors, operating companies, growth companies, developers and governments on core business strategy, investment strategy, financing strategy and capital deployment / infrastructure development and public private partnerships, value creation initiatives, technology roll out programs, transformations and restructurings in North America, Europe, Middle East and Latin America/Caribbean. Aaron has worked extensively across energy transition sectors (renewable power generation, battery storage, hydrogen, clean mobility, waste, water) and core infrastructure sectors (ports, airports, roads, logistics, power and water utilities) and is a frequent speaker and author on sustainable infrastructure financing topics. Prior to Generate Aaron was a Managing Director and Partner at Boston Consulting Group leading work with infrastructure investors on portfolio value creation and supporting governments on large scale infrastructure development and construction programs. Prior to that Aaron was a Partner at McKinsey & Co. where he led large scale transformation programs at power and water utilities, supported development finance institutions and government agencies on infrastructure investment and funding strategy and supported infrastructure investors on strategy and performance improvement programs in the Middle East, Europe, Africa and North America and served on the Millenium Challenge Corporation’s private sector advisory board. During his work advising on the Puerto Rico sovereign restructurings, Aaron was appointed the Revitalization Coordinator for Puerto Rico by the Governor of Puerto Rico and the Federal Oversight Management Board. Prior to McKinsey Aaron was a Senior Associate at Latham & Watkins where he structured and executed project financings, leveraged financings, mergers and acquisitions and large-scale restructurings, including the restructuring of Dubai World for the Government of Dubai. While in Dubai, Aaron founded the Middle East’s first energy transition focused business group the Clean Energy Business Council MENA. Aaron was also an Investment Banking Associate in Credit Suisse’s Energy Group focused on infrastructure financings and M&A. Aaron was a Hamilton Scholar at Columbia Law School where he was awarded a J.D. and graduated from Brown University with a B.A. with Honors. He lives in Washington DC.

Federal funding through the Bipartisan Infrastructure Law, with over $100M specifically allocated to public-private partnerships (P3s), and the Inflation Reduction Act, combined with historic levels of private investment into infrastructure and energy assets, services, and technologies, make this an exciting time for our sector. Furthermore, incentives for state and private entities to realize new and lasting infrastructure exist through the Transportation Infrastructure Finance and Innovation Act (TIFIA), which allows for 49% of projects to be funded with low-interest rate loans, and P3 funding for clean energy and broadband projects.

However, delivering such solutions is no easy task, especially given the desire to integrate new technologies into our energy, mobility, and communications infrastructure (e.g., renewable power, green hydrogen, electric vehicles) and create equitable digital access (e.g., rural broadband), and the inherent complexity of these systems.

We are seeing a growing desire to utilize P3s given the complexity and sheer volume of infrastructure to be delivered and the need to partner with the private sector effectively to integrate and deploy new technologies. Recognizing the need for innovation in infrastructure delivery, alternative delivery models enable effective partnerships between the public sector, private capital, and technology & service providers to maximize public benefit with available funding.

For the next installment of the series Bridging the Gap: Propelling America’s Public Infrastructure Forward, we’ll review best practices in structuring and executing alternative delivery models, how some states have experienced success, and what leaders can do to successfully shape and implement innovative ways of delivering infrastructure.

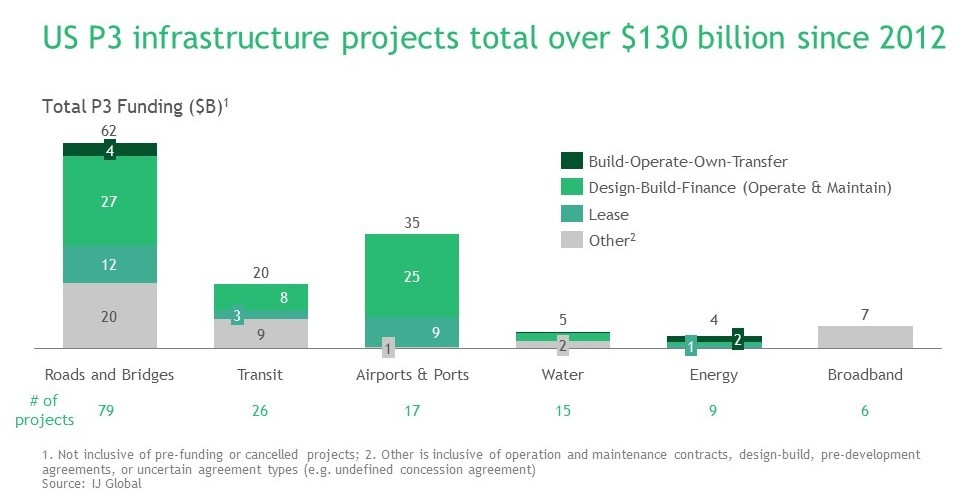

P3s have been used to deliver infrastructure in the U.S. for decades, delivering over 150+ projects worth over $130B since 2012 in roads, transit, airports, water, and more asset classes. The U.S. is the largest P3 market in the world, and some of the nation’s most successful infrastructure projects in recent years have been delivered through P3s. For example, the new LaGuardia Airport project utilized innovative design and construction delivery to minimize disruption during construction and deliver a vastly improved travel experience.

P3s, however, must be thoughtfully designed and managed as challenges often arise in aligning the public and private sectors. For instance, due to these conflicts, a Midwestern state’s airport project was canceled after months of private sector engagement with a highly qualified consortia offering to finance and build, despite potentially injecting millions of dollars into the local economy and creating thousands of jobs.

In instances where P3s succeed, states and localities can create lasting impacts. Prince George’s County Public Schools (PGCPS) in Maryland used a P3 model with a team of private firms to design, finance, construct, and maintain 6 new public schools. In July 2023, this P3 is anticipated to deliver in 4 years what traditional execution models would deliver in 12 years. Furthermore, the 30-year maintenance contract is expected to save up to $180M in deferred O&M costs by transferring the risk of construction and operations to the private sector, converting variable operation and maintenance (O&M) costs into fixed payments. In another Mid-Atlantic state, P3 projects experienced on-time or earlier completion and only 1-3% cost overruns compared to 15+% for traditional delivery. With over $550B in net-new federal infrastructure funding from the federal Infrastructure Investment and Jobs Act, P3s, through minimizing time and cost overruns, have the potential to save up to $83B (approximately 15% saving on the $550B in net-new infrastructure projects) in funding that can then be deployed for other much-needed infrastructure initiatives.

Challenges and Ways to Deliver Successful P3s

Delivering infrastructure using alternative delivery models is complex, and challenges include:

- Lack of clear articulation of goals and fair allocation of risk between partners. P3s often fail when used solely as vehicles to offload risk since incentives between partners can become misaligned. A 2016 report published by the Urban Land Institute (ULI) cites that the greatest hindrance to P3s is the misalignment between private and public capital criteria for investment. P3s require long-term collaboration and, consequently, procuring entities must allocate benefits and risks fairly across the public and private sectors to the parties best placed to manage those risks. P3 planners must also maintain realistic expectations about the market cost of assuming such risks.

- Negative public perception of private involvement in infrastructure delivery. Misconceptions or negative perceptions about a P3 project regarding private sector involvement, including potential conflicts of interest, profit taking, adverse impacts on public services, or use of unfair and/or non-union labor practices may arise, hindering a project’s timeline. Common communication pitfalls include not relaying to the public project details, such as tangible benefits (e.g., traffic reduction, pollution reduction), procurement requirements (e.g., prevailing rates, Buy-America), and rationalization for private-sector partnering (e.g., technical expertise).

- Need for expertise in structuring the new type of deal constructs that P3s require. P3s offer a way to leverage the best of both the public and private spheres to benefit communities. Yet, throughout the infrastructure lifecycle (plan, fund, design, deliver, and maintain), states and localities may lack the knowledge to best shape and negotiate for each phase due to the infrequency of direct implementation experience. Additionally, even when leveraging the experience of advisors, governments may not possess the organizational structure to host forums, workshops, or working groups to systematically gather and process input.

- Perceived risk in long-term performance management. P3s typically involve long-term contractual arrangements, spanning several decades and necessitating robust, but often unfamiliar, mechanisms for monitoring and managing performance. Additionally, a lack of a full understanding of lifecycle costs for P3 infrastructure projects can result in insufficient O&M funding commitments, compounding long-term performance issues.

- Lack of expertise in and understanding of new technologies. State governments often possess a limited understanding of emerging technologies such as broadband, electric vehicle charging infrastructure, and hydrogen energy. This lack of understanding becomes a major issue as governments may struggle to effectively procure and implement these technologies without proper knowledge.

Bringing Together Public and Private Sectors

States can develop a P3 approach that creatively leverages the best of both the public and private sectors. We recommend the following:

- Identify best-fit projects for P3 execution

- Develop a framework for alternative delivery that balances revenue, operations, and risk and can be used to communicate the requirements and benefits to a wide set of stakeholders

- Establish infrastructure capabilities and/or organizations to support alternative delivery ecosystem and execution

Identify best-fit projects for P3 execution

P3s are long-term projects that require close collaboration between the public and private sectors. Accordingly, the P3 model does not fit all infrastructure projects, and states should only consider those where the incentives between public and private are aligned and where the government may not be best positioned to deliver due to either capacity, funding, knowledge, or experience constraints. Considerations that may influence a project’s P3 viability include the benefits for private involvement, clear pathways to optimize private efficiency and effectiveness, a healthy market of competitive providers with sufficient engagement, limitations of public sector capacity, budget and/or ability to deliver and analysis of key trade-offs to balance.

Recommended actions for states:

- Screen the entire infrastructure project pipeline, understand state needs and goals, and identify where opportunities may exist for public-private collaboration. For this process, a team may use a certain cost threshold (e.g., over $400M) and/or litmus test of P3 considerations (such as above).

- For screened and short-listed projects, assess the availability of public funding streams and project competitiveness against state and local budgets to determine the degree of private investment required.

- For emerging technology infrastructure, leverage private-sector advisors to help bridge the knowledge gap and explore potential solutions. In cases where a project does not progress, compensating private partners for their time and expertise ensures a fair and equitable process.

- Hold working groups with relevant stakeholders such as local and municipal agencies, community representatives, and private enterprises to introduce potential P3 projects, solicit feedback, and gauge business and community interest.

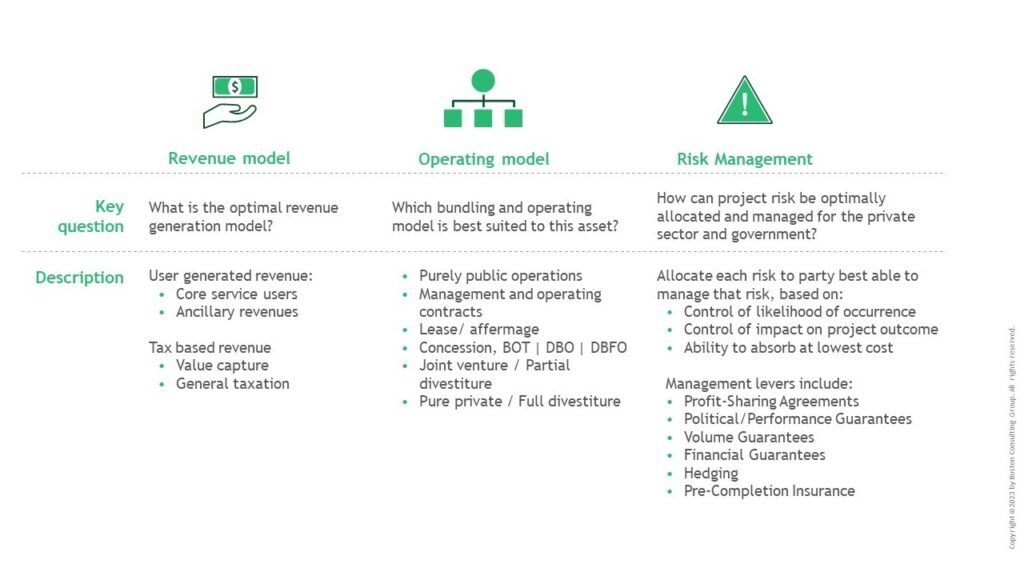

Develop a framework for alternative delivery that balances revenue, operations, and risk

P3 success starts with appropriately structuring the risks and rewards of a project between the public and private sectors. Various models exist within P3 from public ownership with private delivery to public-private co-ownership to private-owned delivery of public resources. States must balance their specific needs against revenue, operations, and risk considerations, thereby setting up projects for success while protecting governments from “giving away the store.”

Recommended actions for states:

- Examine any past or ongoing P3 projects and case studies to understand key success factors and lessons learned; then, assess how these principles can apply to the P3 project pipeline.

- Design and codify framework (such as revenue, operations, and risk) to appropriately structure P3 models. Then, outline optimal revenue, operations, and risk scenarios as well as included assumptions to begin structuring for each project the ideal P3 model.

Establish infrastructure capabilities and organization to support alternative delivery ecosystem and execution

Alternative delivery requires a different approach compared to traditional delivery models. We recommend establishing an infrastructure organization (given a large enough number of P3 projects to support) to act as a P3 center of excellence for state, county, and local teams. This organization which can take the form of a council, agency, or department, can provide resources for funding, partner selection, bid evaluation, long-term monitoring, and more. Additionally, the organization can support P3 planners in obtaining federal funding and support, such as through the Transportation Infrastructure Finance and Innovation Act (TIFIA) which provides loans, loan guarantees, and other forms of credit assistance to help finance projects.

Recommended actions for states:

- Explore engagement and actions needed to establish the infrastructure organization and expand P3 usage and the ability to structure P3s for best value (rather than, only based on, the lowest cost).

- Define the objective of the infrastructure organization, and identify key members to build outlined capabilities (e.g., funding and financing, best-value procurement, long-term KPI tracking)

- Establish quarterly forums to solicit input from professional union representatives, potential private partners (e.g., investors, developers, builders), and other relevant stakeholders to reduce opposition to P3s, especially regarding how P3s can expand—rather than reduce—construction and trade-related jobs.

- Invest in expanding P3 expertise and knowledge sharing by providing resources and organizing training programs to enhance the understanding of P3 case studies, best practices, project preparation, procurement processes, contract management, and O&M monitoring.

- Develop a robust ecosystem of P3 vendors through early involvement in opportunities, better marketing of RFPs, and targeted workshops to engage small- and minority-owned businesses as sub-contractors in P3 projects.

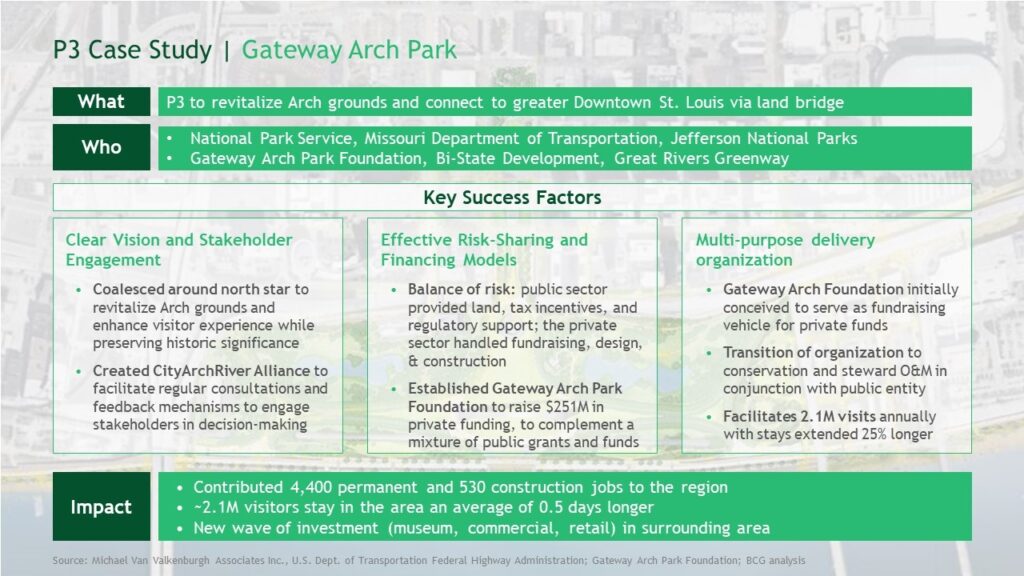

A Case Study

The Gateway Arch Park in Missouri is a prime example of a successful P3 that aimed to deliver a complete redesign for the Gateway Arch grounds and connect its public spaces to those of Downtown St. Louis. Coordinating across stakeholders, effectively sharing risks, and long-term collaboration, the P3 team completed the project on time and on budget while ensuring full visitor access to the Gateway Arch over the entire duration of construction. Public funding totaled $159M from federal, state, and local sources, while the Gateway Arch Park Foundation raised an additional $221M from the private sector, without which the project would have stalled indefinitely. Through a clear vision, the Gateway Arch Park exemplifies how P3s can revitalize public spaces, boost tourism, and preserve cultural heritage.

A More Collaborative Future

P3s offer an innovative model to attract investment and enable the completion of more infrastructure projects. Additionally, they can improve incentives to optimize long-term lifecycle costs without sacrificing on-time and on-budget delivery. Through thoughtful contract structuring, P3s can also create predictability in long-run liabilities and free up public cash flow to fund other critical initiatives. Together, the public and private sectors can transform our infrastructure landscape, foster economic growth, and improve the quality of life for all.

This is the fourth article in our Bridging the Gap: Propelling America’s Public Infrastructure Forward series. Be on the lookout for the next one which will focus on building infrastructure for climate resilience.

More insights

Why the infrastructure transition needs creative credit

Private credit has stepped in to help fill some of the biggest gaps in our capital markets in recent years.

Read moreComfort in the chaos

The policy drivers for the energy transition are new enough that this kind of disruption sparks questions about the durability of the capital, projects, technology development, and deployment of the infrastructure we need to decarbonize in the event of a political shift. But while there are significant differences in the priorities for the energy transition across

Read moreSupporting the electrification of school buses

Substantial federal grant funding, an increasing volume of policy mandates, and mounting pressure from parents, teachers, students, and communities for schools to decarbonize underpin the market. Through the lens of an investor, school buses are prime candidates for electrification: bus routes are predictable and almost always fall within the range offered by EVs available today, most

Read more